The most recent drama in the Real Estate Industry was the cancellation of another preconstruction residential condominium – this one being in Vaughan.

A majority of the public believes that because the developer sold the condominiums for an average price of about $550 per square foot, and other comparable condominiums in the area have recently been selling for as much as $800, there must be foul play involved in the decision to cancel the project.

As a veteran New Condominium Sales and Marketing Manager who has experienced the disappointment of having a project cancelled after the sales were firm, I can report from experience that when you factor in the costs of bringing a project to market twice, no Developer would be motivated to cancel a project for this reason. These costs consist of both time and tangible costs, as well as the damage to the developer’s reputation.

So what caused the problem? There are three components that together, potentially caused this cancellation.

The first was the time it took to change the zoning from industrial (employment land) to high density residential. Despite the lengthy 18 month (or longer) process, many Developers still sell their condo projects before the zoning is in place and successfully go on to complete their projects.

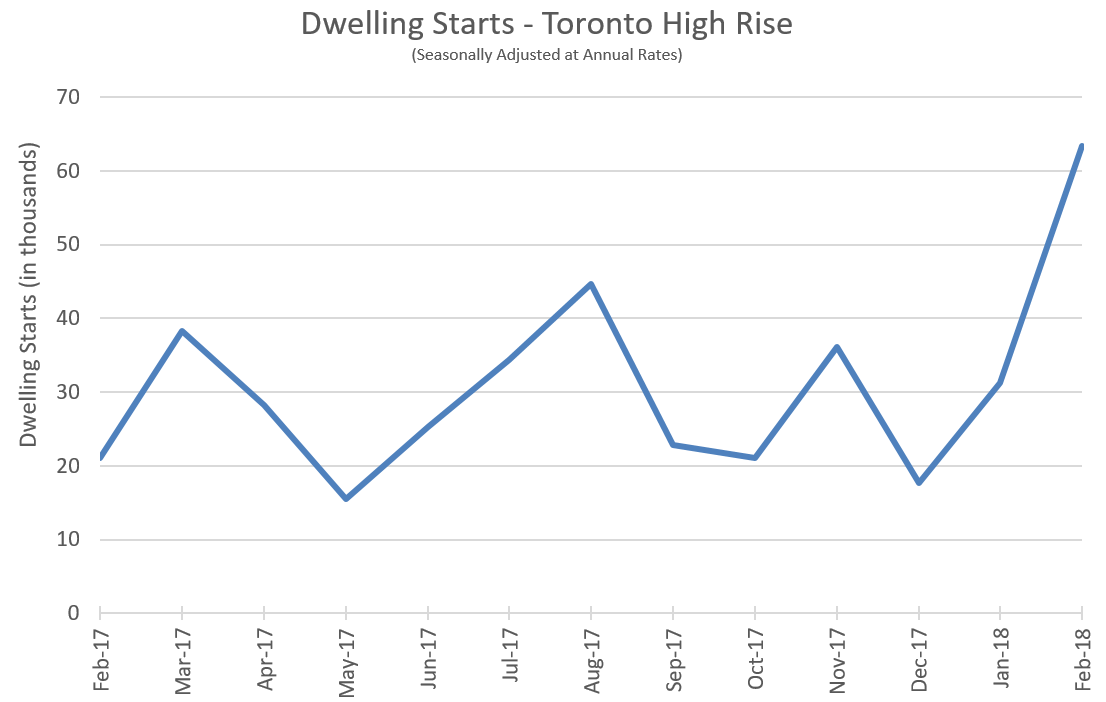

The second component was the recent spike in labour costs to build new homes and condos. The Toronto area has experienced record numbers of sales over the last few years and this year we are experiencing a new record number of high rise housing starts. According to CMHC, Toronto area high rise condo housing starts have tripled to 63,396 units in the latest year over year figures released in February. One of Canada’s top Developers told me during a recent brunch meeting that he has heard of concrete formers, the people who pour the concrete into the forms to build condos, who normally make about $100,000 annually, currently making as much as $250,000 annually. So, the trades have more work than they can do, and this increases what they can charge Developers.

Source: January 2018 Preliminary Housing Start Date, Market Analysis Centre, CMHC & March 2018 Preliminary Housing Start Date, Market Analysis Centre, CMHC

The third potential catalyst will likely surprise you. The cost of the materials used to build condos, which include steel, concrete, glass, and drywall, has also unexpectedly spiked. This is the catalyst that the accountants that do the budgeting for the developers were unable to predict. The cost to manufacture or process these materials is very energy intensive. It also takes a lot of energy to transport these materials to market.

So just a few short months after it was announced, the Provincial Government implemented its version of the Ontario Carbon Tax on January 1, 2018. The result of the “Climate Change Mitigation and Low Carbon Economy Act” is a tax on Ontario providers of electricity, natural gas, and fuel which is automatically passed on to Ontario consumers of energy. The Provincial Government refers to it as a Cap and Trade Program and, according to Ontario.ca e-laws, the layers of regulation and tax in the legislation were rewritten 6 times in the year preceding January 1st of this year, in order to meet or exceed mutual Provincial and Federal Government targets.

Ontario already had the most expensive energy in North America, and is no longer a manufacturing based economy largely due to this fact. As a result, the increasing cost of manufacturing and transporting the building materials, unpredicted by accountants, played a very major catalyst in causing the cancellation of the Vaughan condo.

However, it was likely the combination of a cumbersome zoning change process, and the unexpected spike in labour and building costs that caused the problem. The dramatic spike in costs diminished the profitability of the building to the point that the banks would no longer finance the project. Even if a developer had the means to self-finance, it would only compound the loss, so it would not make financial sense for the developer to do so.

It is important to understand that if the property had been zoned, and construction had begun shortly after the quick sell out, based on prices at that time, this project would have been successfully built.

So what is the solution?

Other than the obvious streamlining of the zoning process and cancellation of the carbon tax, we need to address the labour shortage. One method would be to return to a more merit based immigration system and bring in more skilled labour to build Toronto area condos. Despite a recent spike in Canadian immigration from about 250,000 to 350,000 new immigrants annually, we do not have enough skilled workers for high rise construction.

In addition, there are modern construction materials that are cheaper and do not require the same skilled labour. Prefabricated concrete construction uses dramatically less concrete due to hollow channels, is much quicker to build with, and requires little on-site labour since it is put in place by a crane. Prefabricated zip panels can also be used for interior and exterior walls, are also installed with a crane, and save time, and labour costs.

Consequently, using more modern building materials and building methods would take the pressure off the shortage of skilled labour needed to build Toronto area condominiums. The outcome of the upcoming provincial election could decide the fate of the Ontario Carbon Tax, as other Provincial Premiers do not intend to implement it, a potential new Premier may have the ability to cancel it.

Another tip would be for both the Developers and the buyers of Toronto condominiums, to proceed when zoning is in place to minimize the risk of unforeseen obstacles.

Did I mention that my latest project, Edge Towers, is beginning construction on Tower 1 and that we are about to launch Tower 2 with preliminary zoning approvals in place?